puerto rico tax incentives code

Plan to create or preserve 10 per See more. Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US.

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

With the goal of promoting economic development in Puerto Rico Act.

. The Incentives Code offer tax benefits to businesses engaged in international financial services in Puerto Rico. Make the necessary investment in a commercial enterprise in the United States. Act 60 2019 - Puerto Rico Tax Incentive.

Puerto Rico Incentives Code 60 for prior Acts 2020. The new law does NOT eliminate the existing. On July 1st 2019 the Governor of Puerto Rico signed into law House Bill No.

USCIS administers the EB-5 Program. Act 60 was created in 2019 to establish the new Puerto Rico Incentives Code. As provided by Puerto Rico Incentives Code.

Last reviewed - 21 February 2022. Purpose of Puerto Rico Incentives Code Act 60. The purpose of Act 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks.

In late June 2019 Puerto Rico completed a massive overhaul of their tax incentives enacting the Incentives Code. 60-2019 as amended known as the Puerto Rico Incentive Code issued under Section 606002 which empowers the person who holds the. On July 1 2019 the Government of Puerto.

The Puerto Rico Incentives Code recognizes the importance of direct foreign investment and places the Commonwealth on par with the most competitive global. Act 22 - The Individual Investors Act now included under Act 60 of PR Tax Incentive Code of July 2019 Act 22 as amended also known as The Individual Investors Act. In a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US. Act 22 now Chapter 2 of the Puerto Rico Incentives Code 60 offers lucrative tax incentives to high-net-worth individuals empty nesters retirees and investors. 1635 known as the Incentive Code of Puerto Rico and enrolled as Act No.

There are several laws that provide tax incentives to local and foreign qualifying business activities that establish operations in Puerto Rico. To avail from such benefits a business needs to become an international. Taxes levied on their employment investment.

Implement the provisions of Act No. Many high-net worth Taxpayers are understandably upset about the massive US. Under this program investors and their spouses and unmarried children under 21 are eligible to apply for a Green Card permanent residence if they.

Corporate - Tax credits and incentives. The purpose of Puerto Rico Incentives Code 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks. The Governor of Puerto Rico on 1 July 2019 signed into law House Bill 1635 into Act 60-2019.

Pr 480 30 Ii 2021 2022 Fill And Sign Printable Template Online Us Legal Forms

Puerto Rico Act 60 How You Can Lower Your Federal And State Tax Rates Under The Resident Tax Incentive Code Anchin Block Anchin Llp

Puerto Rico Tax Incentives Act 20 22 Delerme Cpa

Webcast November 12 2021 Individual Investors And Export Services Youtube

The New Puerto Rico Incentives Code

Act 22 Individual Investors Puerto Rico Tax Incentives

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

More Biotechs Attracted To Puerto Rico Bioprocess Insiderbioprocess International

Opportunity Zones Committee Defines Eligible Commercial Activities Business Theweeklyjournal Com

Puerto Rico Act 60 How You Can Lower Your Federal And State Tax Rates Under The Resident Tax Incentive Code Anchin Block Anchin Llp

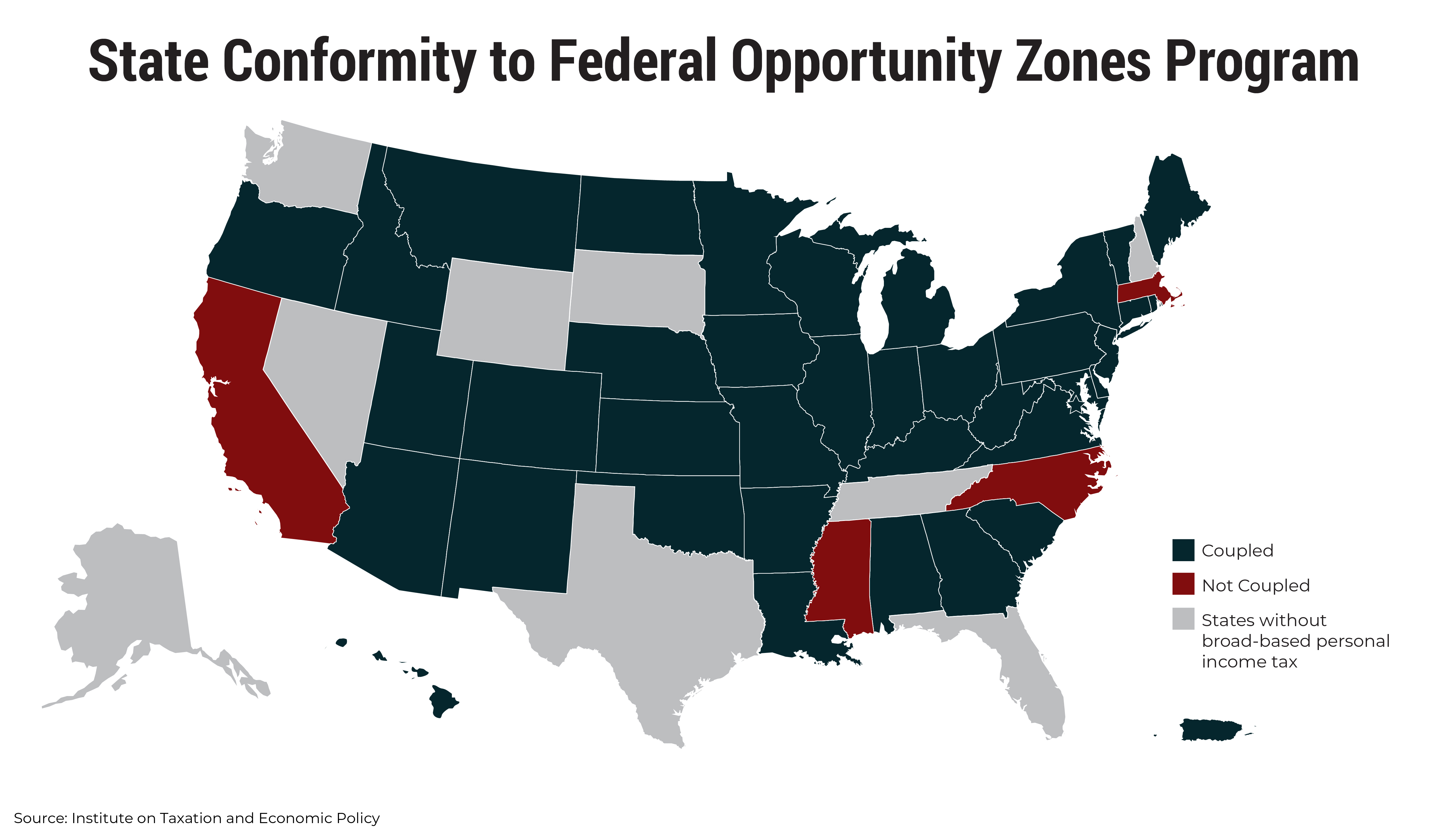

States Should Decouple From Costly Federal Opportunity Zones And Reject Look Alike Programs Itep

Puerto Rico Offers The Lowest Effective Corporate Income Tax

The New Puerto Rico Incentives Code Effective January 1 2020

Puerto Rico Incentives Code Department Of Economic Development And Commerce

Carveouts From Overseas Profits Tax Sought For Us Territories Roll Call

Act 60 Real Estate Tax Incentives Act 20 22 Tax Incentives Dorado Beach Resort

Insight Puerto Rico Source Income As An Opportunity To Generate Tax Efficiencies